Since the financial crisis in 2008/09 the Federal Reserve has printed trillions of dollars and purchased assets with them, mostly US government bonds and mortgage-backed securities. This has caused the assets on the Fed’s balance sheet to swell by around $2.5 trillion since the collapse of Lehman Brothers.

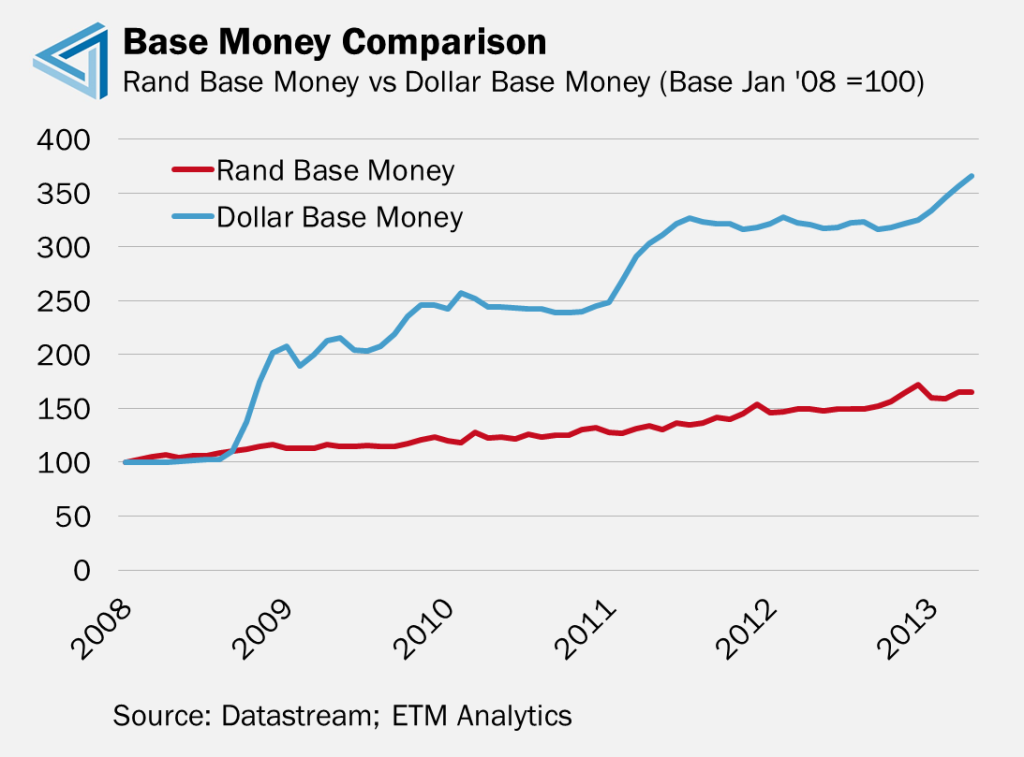

Operations of this magnitude have caused the US monetary base to soar. In comparison we can see that base money in South Africa has not grown by anywhere near the same magnitude as it has in the US. In the graph below sourced from ETM Analytics, rand base money supply and dollar base money supply are both indexed to 100 at the start of 2008.

Immediately after the acute phase of the financial crisis (Sep 2008-March 2009) the rand, which had weakened sharply in the panic, began to strengthen. It recovered from R11.85/$ in October 2008 to R6.50/$ by December 2010.

This rand recovery has stunningly been reversed since mid-2011, with the exchange rate rising from R6.50/$ to R10.30/$. The question on people’s minds is: why has the rand weakened so much once again? America seems to be plodding along ok and there was no Lehman Brother’s event. This is even more perplexing to some given that America is commonly accused of being the arch global money printer, as we saw above.

The answer, in part, lies in the fact that base money is only half the story.

Actual money supply, the kind that people use to trade and invest with, is what is known as broad money supply, and this is much more than just the base money supply. Base money supply is essentially the physical notes and coin in the economy and financial system. Much of the base money is not actually notes and coin but merely digital book entries on bank computers, but for all practical purposes base money is the stuff that you draw out the bank and hold in your hands.

Broad money is created when banks, who are granted a special licence by the state to do this, use base money as a reserve fund with which to grant loans far in excess of the amount of base money. Banks essentially take a base money deposit and lend most of it to someone else, while at the same time telling the depositor that he can withdraw it at any time he wants. They do this over and over again until the value of loans exceeds the actual amount of base money by 10, 50 or even 100 times. These loans then circulate as if they were actual money. People transfer these loan amounts between their online bank accounts, using them to make actual payments. The government even recognises these loans as money and confers legal tender status upon them. It’s quite a privilege to have a banking licence – you can literally print money!

This process is known as fractional reserve banking. The key points to note from this process are that:

- Banks create money supply when they make loans

- This is called broad money and is sometimes denoted by various technical definitions such as M1, M2 or M3. Some Austrian scholars even like to construct their own definitions of the money supply such AMS or TMS, but it basically boils down to loans. If banks make loans, money is created.

- Broad money supply is what affects prices since it is the money that is used in trade and investment.

- Exchange rates are also prices, so it stands to reason that exchange rates are more affected by broad money supply than by base money, particularly when base money is mostly stored in the central bank vaults and only used quite minimally in actual trade and investment in its physical cash form.

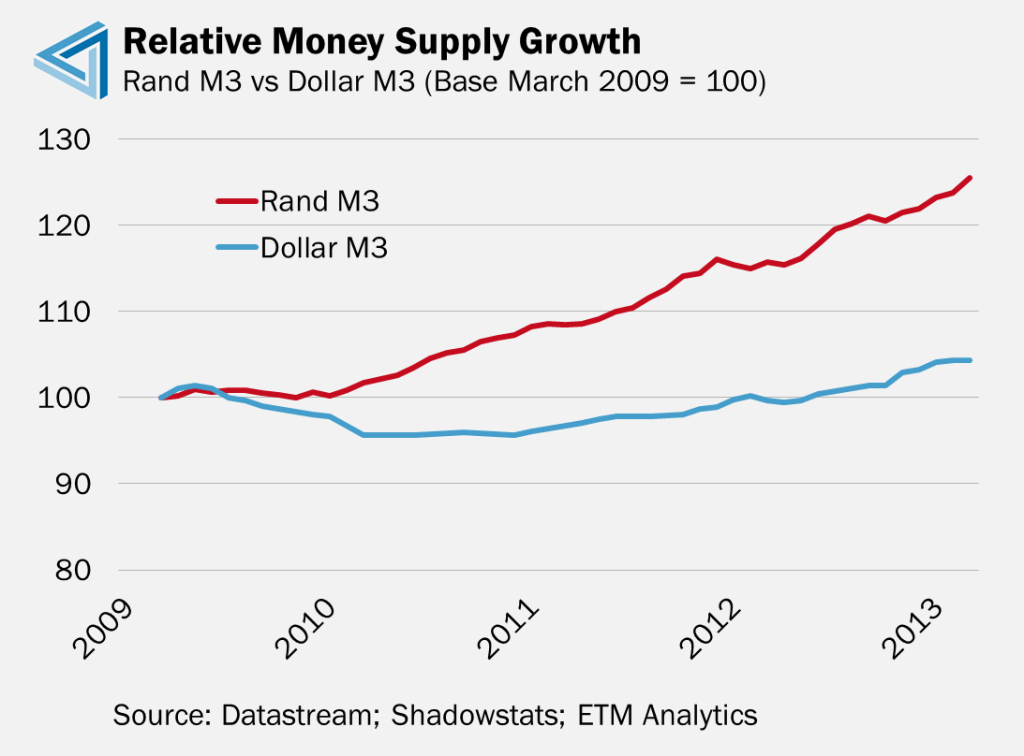

We showed above how dollar base money had grown much faster than rand base money since 2008. Below, again from an ETM Analytics graph, we see the picture for broad money.

Yip, it’s almost exactly the reverse. Strong rand broad money growth, and hardly any dollar broad money growth since March 2009 (when global equity markets bottomed out and started recovering due to Fed monetary stimulus).

By now you’re probably seeing where this is going: huge base money growth, small broad money growth (US), and small base money growth, strong broad money growth (SA).

The reason for this is the state of credit markets and the fractional reserve banking system.

US banks in 2009 were basically dead. Kaput. The base money injection was the act of the Fed buying assets from the banks to rescue them. The banks then had base money, which usually means they can create new loans to the tune of many multiples of the base money. Great news right? Wrong. The Fed figured that this ability to loan could explode the broad money supply and lead to a weaker dollar and runaway inflation. It would have.

So in late 2008, as the Fed was injecting huge amounts of base money onto banks’ balance sheets, it went to Congress and applied for a new law to be passed allowing the Fed, hitherto prohibited from doing such, to pay interest on excess reserves held with the Fed. In other words, the Fed effectively said to the banks: “you may use the base money to pyramid trillions of new loans, but that’s dangerous, so instead put all that base money on deposit with us at the Fed and we’ll pay you interest on that money. It may not be a high interest rate, but at least it’ll be something and you’ll earn a yield of it for ZERO risk.”

So on the whole the banks parked their base money with the Fed and earned interest. At the same time, after the lending boom of the 2000s, the banks found it increasingly difficult to lend money. Who wanted to borrow? The US government sure did, but many households and companies wanted to pay off their debts. If loans create broad money supply, paying off loans basically destroys money supply. Banks were making new loans (creating money) but lots of people were paying off loans (destroying money). The net effect was that dollar M3, the broadest measure of global dollar money supply, basically stagnated between 2009-2012.

So, between the Fed encouraging banks NOT to lend off their new injection of base money, and a US and global economy saturated with dollar debt and not keen to borrow more, dollar broad money has hardly grown since the financial crisis.

Which brings us all the way back to the rand, because in South Africa, the banks entered the financial crisis in a relatively sound state. South African households and companies and the government, although all heavily indebted, have been far more willing and able to take on more debt. So while base money in South Africa hasn’t grown nearly as much as in the US, broad money growth has been much stronger.

And so we arrive at the paradox of the rand. The fact that South Africa’s fractional reserve banking system and credit markets are less saturated with debt than in the United States means they are able to lend much more (in relative terms) than US banks. And this means that the rand is becoming relatively more abundant than the dollar.

This faster growth in broad rand money supply has been one of the important factors driving the rand weaker. In other words, if your banking system still has life left in it, watch out: your currency is probably going to be in for a rough ride.