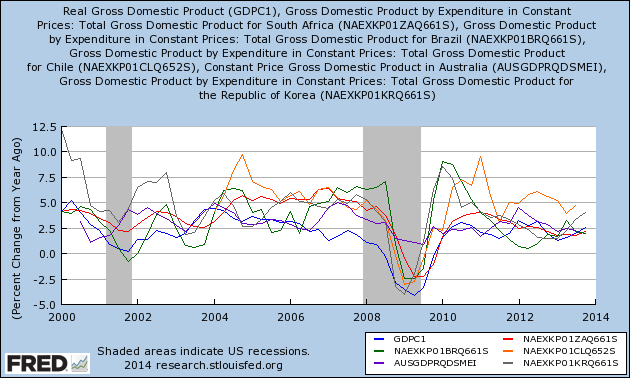

Roger McKinney has a good piece over at Mises.org. It is useful because it describes very simply how Fed policy with the world’s reserve currency can internationalise the business cycle. This is relevant in particular for our African and South African readers, all of whom have experienced (whether they know it or not) the business cycle effects of dollar debasement. The implication? Africa’s boom cycle is vulnerable to a major bust as major investments are revealed to be malinvestments.

This view reiterates the fact that the Fed, whether it likes it or not, is setting monetary policy for the whole world and causing far greater cyclical gyrations in emerging markets than in the US itself. This exportation of volatile business cycles is the main driver of emerging market (EM) direction and internal macroeconomic policies right now.

Some have argued that the Fed doesn’t impact EMs that much and that much of the EM turmoil is of EMs’ own making. That’s a quaint, idealistic little view, but if you think the monopoly supply controller of the global currency doesn’t have enormous sway over EM business cycles, then your eyes have been closed since the turn of the century.

Not only is the Fed running global monetary policy, it’s doing it badly. Seemingly creating stability at home (this is even questionable), it’s fostering instability abroad. Small open economies are forced into a corner. If they want exchange rate control and an open capital account they relinquish policy autonomy (Many Asian economies and oil producers, some LatAm). If they want policy autonomy and exchange rate control, they relinquish capital account openness (China). If they want open capital flows and policy autonomy, they relinquish exchange rate control (South Africa, much of Sub-Saharan Africa, some LatAm).

This ‘trilemma’ is well-known, but in a world of now abnormal Fed money pumping and capital flows it has taken on a life all of its own. EM sovereignty and monetary self-determination is being challenged on a whole new level as the Fed tries to save the American economy.

It is true EMs could be better behaved. After all, macroeconomic policy is just as or more broken in the EMs as it is in the US. But it nonetheless makes it very hard when you’re locked into a global monetary arrangement where the dollar is king and controlled by someone else embarking on huge liquidity injections. The alternative for EMs? Let their currencies strengthen against the US dollar. But there is short term pain associated with this option, which is why few persue it.

What we saw in early 2014 in the EMs felt like the opening salvo in a great EM unravelling after the post-GFC boom. Tightening dollar liquidity will be the chief catalyst for this bust, and how the Fed responds to this in turn will determine the depth and extent of it. As of yet, Fed liquidity might be slowing, but it certainly isn’t contracting, and despite the QE taper the Fed’s balance sheet continues to look like a rocket heading into orbit.

Perhaps that is why EMs are receiving some respite – Actual market liquidity flow remains robust on $65bn/month of QE. That picture will change on only $20bn/month QE, or $0, or rate hikes, but a dovish Fed may very well taper the taper before then.

Fiat Money and Business Cycles in Emerging Markets

Roger McKinney

After the stock market collapse of 2008 and a decline of 3.4 percent for U.S. GDP in 2009, investors rushed to stash funds in emerging markets (EM) where economies were growing at a 3.1 percent annual rate. But the US stock market fell in January of this year largely due to financial trouble in emerging markets. The economies of EM nations, such as, Brazil, Russia, India, Turkey, Thailand, and China, have deteriorated in part because of the withdrawal of US dollar investments from them. Here is a chart from the Institute for International Finance (IIF)[1] showing the capital flows to EM nations:

This dynamic confirms the effects of monetary policy as described by the ABCT, the Austrian business cycle theory. The ABCT states that inflationary monetary policies, such as those of the Fed for the past five years, will cause an unsustainable boom as new money pours into the economy and stimulates demand for consumer goods and capital goods, increasing prices and the relative price of capital goods. Usually we think of the ABCT in terms of a single nation, but the EM problems demonstrate that it has international implications as well, especially in a world of increasing trade integration and a currency that other countries use for trade and their banks keep for reserves, such as the US dollar and the Euro.

Mises wrote about the international effects of banks creating more credit money than the domestic population wants to hold:

The role money plays in international trade is not different from that which it plays in domestic trade. Money is no less a medium of exchange in foreign trade than it is in domestic trade. Both in domestic trade and in international trade purchases and sales result in a more than passing change in the cash holdings of individuals and firms only if people are purposely intent upon increasing or restricting the size of their cash holdings. A surplus of money flows into a country only when its residents are more eager to increase their cash holdings than are the foreigners. An outflow of money occurs only if the residents are more eager to reduce their cash holdings than are the foreigners. A transfer of money from one country into another country which is not compensated by a transfer in the opposite direction is never the unintended result of international trade transactions. It is always the outcome of intended changes in the cash holdings of the residents. Just as wheat is exported only if a country’s residents want to export a surplus of wheat, so money is exported only if the residents want to export a sum of money which they consider as a surplus.[2]

What Mises wrote is backward to what mainstream economics and the financial media teach: trade in goods happen first then money follows to square the balances. While Mises wrote about international trade, the same principle applies to international investing. Just as consumers will buy imported goods (export money) if the Fed creates more money than US citizens want to hold, investors will “import” investment opportunities (export money for investment) if the Fed creates more new money than investors want to hold. As a result, the Fed exports its unsustainable boom, often to emerging market countries. That is one reason that the Fed monetary pump has not generated the higher price inflation in the US that the mainstream economists would like.

The export of US investment dollars to EM countries caused a boom in those economies, but the threat of reduced credit expansion by the Fed has brought turmoil. Of course, the Fed had done nothing but nip at the massive bond purchases by cutting back ten of 80 billion dollars in purchases per month. The Fed advertises that it will keep interest rates near zero indefinitely. That means that money flowing to emerging markets may increase in the future as the IIF forecasts. Eventually, the Fed will be forced to raise interest rates and at that time EM nations must pay the price. As Mises wrote:

One of the main objectives of currency devaluation — whether large-scale or small-scale — is … to rearrange foreign trade conditions. These effects upon foreign trade make it impossible for a small nation to take its own course in currency manipulation irrespective of what those countries are doing with whom its trade relations are closest. Such nations are forced to follow in the wake of a foreign country’s monetary policies.

The emerging market situation reflects another aspect of the ABCT: most emerging market nations export commodities such as metals, food, coal, and oil. In the Austrian taxonomy, they produce higher order goods, consumer goods being the lower order. In another analogy, commodities are at the headwaters of the stream of production and flow through many transformations before becoming consumer goods. Commodities are much more sensitive to changes in the money supply because producing them requires capital intensive processes. Production is much more volatile than consumer goods.